Businesses for sale in Ontario

Introduction to Businesses for Sale in Ontario

Explore a diverse range of businesses for sale in Ontario, Canada's thriving economic hub. With a vast array of options spanning various industries, Ontario presents a unique opportunity for aspiring entrepreneurs. Opting to purchase an existing business in this province not only offers immediate access to an established customer base, trained staff, and capital assets but also ensures a smoother transition into business ownership. Dive into our comprehensive listings and discover the perfect business opportunity that aligns with your vision and goals."

Why Buy a Business in Ontario?

According to IBISWorld, Ontario has a $758.9 billion GDP and over 1,007,992 businesses, making it one of North America's best regions for entrepreneurs. The diverse, thriving business climate provides opportunities across sectors ranging from restaurants to manufacturing to professional services.

However, it's important to note that 96% of small businesses survive their first year, and only 70% reach the five-year mark. Microenterprises fare slightly better. The main reasons for failure are inexperienced management and poor planning. Therefore, business owners need expertise in their field for long-term success, strong management skills, and a solid business plan.

Specific advantages of buying an existing business include:

Access to instant customer base and reputation

Startup costs and time are avoided by acquiring assets rather than purchasing/leasing

Existing staff and management to ensure a smooth transition

Proven products, services, and business processes

Revenue, profits, and cash flows right out of the gate

Ontario also provides easy access to Canadian and international markets, especially the eastern U.S. The multicultural workforce facilitates products and services with broad demographic appeal.

Market Trends and Opportunities

Ontario's most profitable industries, according to IBISWorld, are:

Commercial Banking – $97.4 billion in revenue

New Car Dealers – $54.1 billion in revenue

Automobile Wholesaling – $42.4 billion in revenue

A car dealership is a business with consistent profit potential, especially if services are expanded beyond local markets.

Other top sectors include food and beverage, healthcare, construction, automotive, and e-commerce businesses that can readily scale and export beyond Ontario.

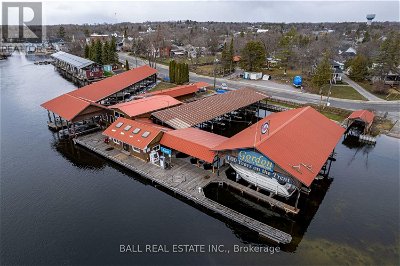

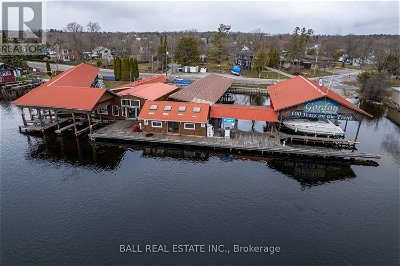

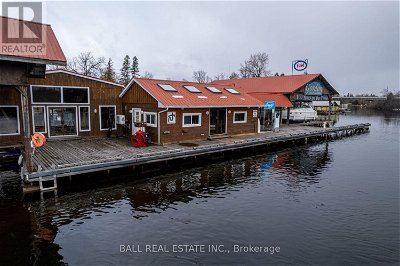

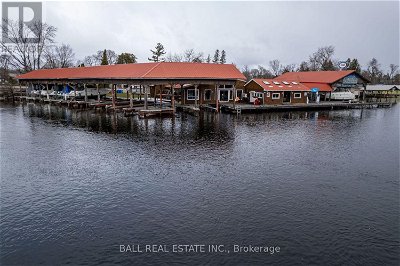

Prime regions for business buyers include Toronto, Ottawa, Hamilton, London, Waterloo, Windsor-Kingston corridor, and anywhere along Lake Ontario, bringing tourist traffic.

Types of Businesses for Sale in Ontario

Manufacturing

From automotive parts to machinery to food production, Ontario’s diverse manufacturing sector presents options to purchase suppliers across many industries. Look for companies with solid facility infrastructure, advanced equipment, trained staff, intellectual property, and established distribution pipelines.

Ideally, financials will show steady revenues and profits not tied to just one major customer. Purchase inventory and materials to keep production running seamlessly. Leverage existing technical expertise to improve processes and profit margins after taking over.

Retail

Independent pharmacies, clothing boutiques, liquor stores, garden centers, and other brick-and-mortar retailers provide products and services in demand from local populations. Assuming an existing lease allows new owners to avoid costly build-outs.

Offering unique items not readily available online will help retailers compete with e-commerce giants. Look for stable recurring revenues and cash flows based on area foot traffic patterns rather than one-time surges. Be prepared to refresh inventory with new items that excite customers.

Restaurants and Food Services

From mom-and-pop diners to food trucks to catering operations, ready-to-go food businesses allow new owners to inherit functional commercial kitchens, reliable staff, and menu items customers love.

Ideally, the outgoing owner will provide training on proprietary recipes and techniques. Look for opportunities to expand hours, add locations, or drive higher order values through improved marketing and search visibility. Utilize unused capacity for catering and special events.

Professional Services

Accounting firms, dental practices, law offices, marketing agencies, IT consultancies, and more often get put up for sale as founders near retirement. This lets new owners gain an immediate business book from established client relationships.

Ensure client retention contracts and non-compete agreements are signed to retain revenues after the departure of previous owners. Seek opportunities to upsell existing clients and land new ones through improved digital presence and search optimization.

Online Businesses

Many online companies now operate almost entirely virtually, providing products and services to customers worldwide. These include e-commerce retailers, SaaS providers, agencies offering web development, digital marketing services, and more.

Scalability is a major advantage, allowing small teams to generate seven-plus-figure revenues. Examine site traffic, conversion rates, churn, lifetime value per customer, and expenses determining profitability. With minimal overhead, cash flows can fuel further growth.

Searching for Businesses for Sale in Ontario

Online Listings

The first stop for most buyers is online marketplaces that aggregate available businesses for sale across the province and country. Largest sites include BizBuySell, LoopNet, and BusinessBroker. These let you search by location, industry, price range, cash flow, and other criteria. Listings provide overviews of the business, financials, and asking price. Create alerts for new listings matching your parameters.

Business Brokers

Business brokers play a similar role to real estate brokers, helping to facilitate sales between buyers and sellers. They tap into industry connections to help uncover off-market opportunities not publicly listed yet. Brokers qualify and vet prospective buyers, provide guidance on valuations, negotiate deals, and handle paperwork for you in exchange for a success fee.

Attending Industry Events

Industry conferences, trade shows, and networking events attract key sector players. These provide opportunities to connect directly with business owners and learn gossip of who may be considering selling. Pitches for your services may also make business owners realize it’s time to cash out. Attend large general events and small gatherings specific to your niche.

Networking and Word of Mouth

Speaking directly with business owners themselves or professionals who advise them—like accountants, lawyers, and bankers—can uncover opportunities before they formally hit the market. Well-connected individuals often hear the buzz around an owner considering retiring or moving on. Warm introductions through your network give you an advantage over cold calls and emails.

Evaluating a Business for Sale

Once you’ve identified potential acquisition targets, dive deeper into assessing if the opportunity is right for you. Be thorough in your due diligence to avoid overpaying or buying underlying problems hidden beneath the surface.

Financial Statements and Valuation

Review historical financial statements from the past 3-5 years. Look for steady revenues, profits, and cash flows over this timeframe. Calculate ratios like P/E multiples and sales margins to determine appropriate valuation. Average industry benchmarks to identify underpriced or overpriced businesses relative to their performance.

Industry Analysis

Conduct in-depth research on the industry's current state and future outlook overall and locally. Seek industry reports forecasting growth, consolidation, tech disruption, and competitive forces. This will reveal risks and tailwinds that will impact the business post-purchase—target growing fields with room for new entrants to capture share.

Location and Market Potential

Evaluate area demographics, economic health, infrastructure, traffic patterns, parking, neighborhood vibrancy, visibility, competition density, and access to suppliers, partners, and talent. Ensure the location supports continued access to the customer base and resources needed to succeed.

Competition and Market Share

Profile direct competitors and alternatives customers may turn to. Determine your differentiators and what barriers make it challenging for newcomers to compete with the business. Look for a defendable niche or loyal customer base. Analyze historical and projected market share trends to see whether the business is gaining or losing ground among rivals.

Assets and Intellectual Property

Catalog all assets like real estate, facilities, vehicles, equipment, hardware, inventory, and intellectual property. Inspect the condition and remaining usable life of assets. Determine any liabilities you will assume as the new owner—value intangible assets like brand identity, patents, processes, and customer data.

Staff and Management

Getting to know key personnel, especially those in leadership roles, provides a sense of talent strengths and gaps that may need to be addressed. Determine if critical employees are likely to stay after the acquisition. Make offers contingent on retaining management vital to operations. Prepare incentives to prevent turnover.

Financing the Purchase of a Business

For most buyers, securing financing is key to acquiring a business. Explore all options to determine the best funding sources for your needs and qualifications as a borrower.

Bank Loans

One of the most common routes is obtaining a small business or SBA-backed loan from a major bank. Polished business plans and financials are needed to qualify and maximize loan amounts approved. Accounts receivable, inventory, real estate, and equipment may be used as collateral. Recent industry growth trends will help support the need for capital.

Seller Financing

Sellers may agree to owner financing deals, allowing you to make payments over an agreed timeframe instead of one lump sum. This can get deals done when outside funding is constrained. Make sure sale documents protect you as the buyer in case of default. Only agree to terms you can confidently meet.

Angel Investors and Venture Capital

Equity financing from angels or VCs provides capital in exchange for partial ownership in your business. This allows you to scale aggressively. Connect with investment groups focused on your industry and be prepared to deliver a compelling business plan and growth projections.

Business Grants and Incentives

Federal, provincial, and municipal programs provide grants to entrepreneurs, minorities, immigrants, veterans, women, and other underrepresented groups to help finance a business purchase. Grants support local economic development initiatives. Discover if you qualify for entrepreneurship, small business, or industry-specific subsidies or incentives.

Legal Considerations When Buying a Business in Ontario

To ensure the acquisition proceeds smoothly and legally, engage lawyers and accountants to examine key items early on.

Business Licenses and Permits

Verify all licenses, permits, and registrations needed to operate are up-to-date and ready to be transferred to the new owner. Renew or apply for any new ones you may need.

Employment Considerations

Review employee records for issues related to wrongful termination, discrimination, harassment, overtime, or labor regulations. Have counsel assess risks.

Environmental Factors

For businesses with facilities, environmental assessments uncover risks like underground tanks, contaminated soil, asbestos, lead, or other hazards needing remediation.

Non-Compete Agreements

Ensure non-compete/non-solicitation agreements are signed by key owners and personnel with trade secrets or relationships you want to retain. Record these to protect the business.

Review of Major Contracts

With guidance from legal counsel, review supplier, vendor, lease, franchise, and other major contracts. Determine assignability to the new owner or if renegotiation is required.

Understanding the Choice: Assuming a Corporation or Not

When purchasing a business for sale, buyers can either assume an existing corporation or not. This decision carries significant implications, as assuming an existing corporation means inheriting all its associated problems. It's a complex area that requires careful consideration and expert legal guidance. A good lawyer can help you navigate these complexities, ensuring you make a decision that aligns with your interests and protects you from potential liabilities.

Closing the Deal

The purchase process concludes with final negotiations, paperwork, and legal transfer of the business to you.

Negotiating Terms

Hire legal and accounting advisors to negotiate prices, timelines, contingencies, transition assistance, and other terms favorable to you as the buyer.

Due Diligence

Scrutinize all records related to finances, taxes, operations, legal issues, employee matters, and property conditions. Uncover any red flags before transfer.

Performing due diligence is your shield and weapon – protecting you against unwise investments while empowering you toward profitable ventures. Due diligence is a crucial step when buying a business in Toronto. It helps to mitigate unforeseen issues post-purchase through careful evaluation of the following:

- Drafting Purchase Agreement: A comprehensive, clear purchase agreement outlines the terms of sale and can help avoid future disputes. Engaging a lawyer can ensure all elements are well-covered.

License and Permit Transfer: The enterprise may necessitate certain operational licenses or authorizations. Ensure these are handed over to you as the succeeding owner for legal conformity. For example, when acquiring an 'Ontario convenience store,' consider permits that cannot be transferred, such as alcohol licenses or specialized certifications.

Compliance with Provincial Regulations: Ensure the business adheres to Ontario's business regulations, which can vary by industry. This could involve employment laws, environmental regulations, and sector-specific rules.

Financial Due Diligence: Conduct a comprehensive analysis of financial documents, encompassing tax filings, sales records, payroll details, obligations, rental agreements, and additional costs.

Legal Due Diligence: Scrutinize all legal agreements, including rental and supplier contracts. Collaborate with professionals such as attorneys specialized in mergers and acquisitions to verify there are no concealed liabilities, potential legal complications, and necessary seller claims.

Real Estate Due Diligence: If the sale includes real estate, confirm property ownership, evaluate its status and worth, and guarantee it abides by the relevant zoning laws.

Strategies for Success After Purchase

Once you’ve closed the deal, executing well-planned strategies will help your transition and ownership get off to a strong start.

Transition Plan

Create a detailed 100-day transition plan for changes related to staff, systems, branding, marketing, policies, and processes needed to scale up the business. Outline longer-term (1-3 years) goals.

Business Expansion

Look for quick opportunities to grow the newly acquired business through new products, services, territories, distribution channels, and target customer segments.

Marketing Refinement

Refine branding, messaging, digital marketing, and lead generation strategies to reach new demographics and increase visibility. Boost ROI from marketing initiatives.

Staff Training and Development

Invest in training programs to elevate staff skills, especially around new systems and products. Hire strategically to fill knowledge gaps preventing expansion.

Establishing an Exit Strategy

Develop eventual exit plans through selling to a new owner, management buyout, employee stock ownership plans, or family succession. This provides a long-term perspective.

FAQ

How do I know when my Canadian business needs a registration number?

In Canada, most businesses must register for tax purposes and obtain a business number. Learn more from the Canada Revenue Agency (CRA).

How can I find businesses available for purchase in Ontario that match my budget and industry preferences?

If you're looking for businesses up for sale in Ontario that align with your budget and industry preferences, there are platforms like FindBusinesses4Sale where you can explore options. These platforms allow you to narrow your search based on location, industry type, and price range. Alternatively, you can also seek assistance from a business broker who can help you find opportunities.

How can I determine the market value of a listed business for sale in Ontario?

The best way to assess the market price of a business listed for sale in Ontario is to consult a business valuator. They have the expertise to analyze statements, company assets, and projected earnings. Additionally, researching businesses in the area can provide insights into market trends and pricing.

What kind of guidance or support should I seek when considering purchasing a business in Ontario?

When considering buying a business in Ontario, it's important to contact professionals specializing in business transactions, like accountants, business brokers, or lawyers. They have the expertise to assist you with understanding tax implications and properly evaluating the business. Relying on their knowledge will help you make a decision.

Are there financing options for buying a business in Ontario?

If you plan to acquire a business in Ontario, there are financing options. You can explore government-supported bank loans offered by institutions like the Business Development Bank of Canada. Additionally, private lenders or investors might be interested in providing financing solutions. It's essential to consider sources of financing to find the option that best fits your requirements for acquiring a business.

How to find the best deals on properties for Businesses in Ontario?

Discovering the best deals on Businesses in Ontario requires thorough research. Take into account factors such as location, size, amenities, and future growth potential. Explore the three most popular offers:

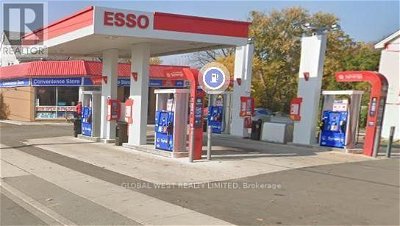

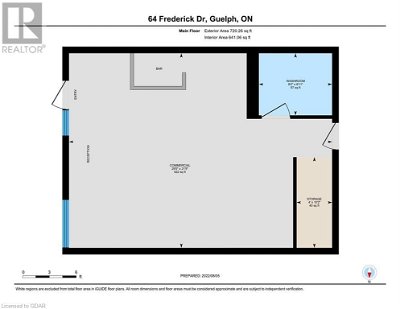

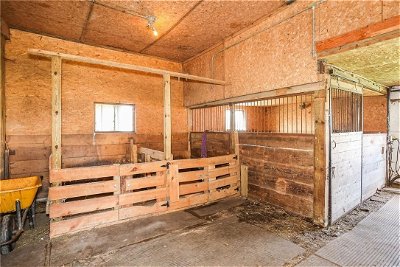

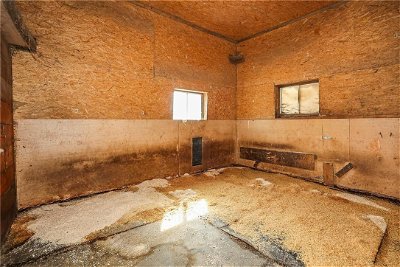

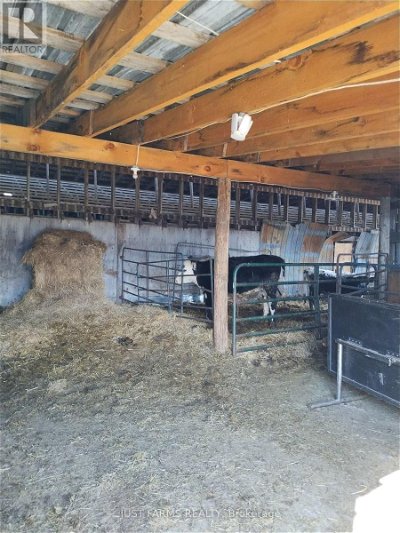

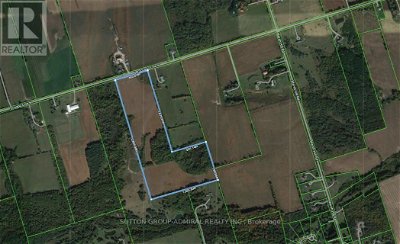

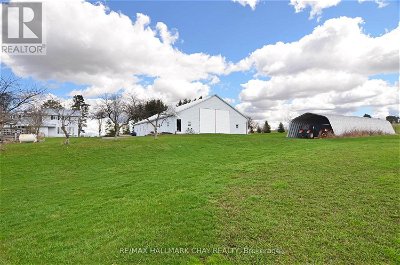

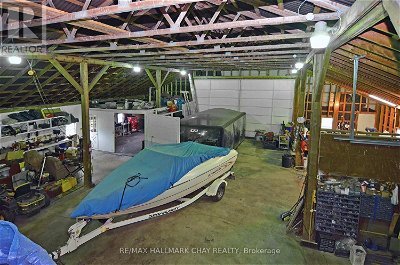

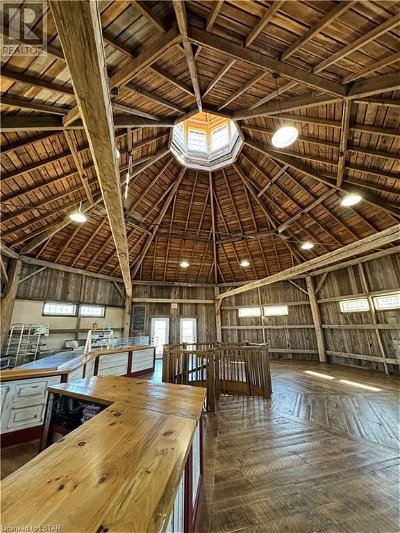

Gas Station at 1 TASKER ST , Hospitality Properties at 64 FREDERICK Drive Unit# 102 and Farm at 211 ROBINSON Road .

What is the average price of Businesses in Ontario?

The average price of Businesses in Ontario is influenced by various factors. On average, prices range from $1,774,804. However, conducting a comprehensive market analysis is essential to grasp specific pricing trends in your desired area.

Where can you find information about Businesses in Ontario?

Find comprehensive information about Businesses in Ontario on Find Businesses 4 Sale! Explore our catalog of offers, and if you have any questions, feel free to contact us; we're here to help! Meanwhile, consider checking out the three newest listings:

Gas Station at 1 TASKER ST , Hospitality Properties at 64 FREDERICK Drive Unit# 102 and Farm at 211 ROBINSON Road . .

Save Search

Save Search