Gas Stations for sale in BC

Introduction to Buying a Gas Station in British Columbia

Exploring the opportunity to purchase a gas station in British Columbia is an exciting and potentially rewarding venture. With thorough research and strategic planning, you can understand the vibrant market dynamics and navigate the acquisition process smoothly. Gas stations for sale in BC offer a unique chance to tap into a thriving industry and make a significant impact.

Why Consider Buying a Gas Station?

Owning a gas station provides a relatively stable business model fueled by consistent demand for gasoline and convenience items. British Columbia is an ideal market, with over 1,368 stations across the province and room for growth.

Other advantages include:

Essential product offering

Steady customer traffic

Additional revenue from convenience stores

Brand equity with major chains

Appreciating real estate value

Buying a gas station can be a good investment if you plan it carefully.

Understanding the Gas Station Market in BC

British Columbia has a well-established gas station industry, with a mix of major brands and independents. Gaining market insights helps assess opportunities.

Key Players in the BC Gas Station Market

The market is dominated by large chains like Petro-Canada, Chevron, Shell, Esso, Parkland Fuel, and Husky. These make up over 60% of stations. The rest are independent or smaller regional chains.

Gas Station Market Trends in BC

The market has seen consolidation, with major brands acquiring independents. Margins are thin, averaging 10-15 cents per liter. Convenience stores are essential revenue drivers. Electric vehicle adoption is growing, necessitating charging infrastructure.

BC's carbon tax and high urban real estate costs pose challenges, but the market remains stable, aided by strong tourism. Revenue is projected to grow 1.3% annually through 2025.

Factors to Consider When Buying a Gas Station in BC

Location and Traffic Volume

Selecting a site with high visibility and easy access along major roads is critical. Corner lots near highways exist, or residential areas are ideal. Check zoning laws and any development plans that could impact traffic flow.

Type of Gas Station: Unbranded vs Branded

Branded stations enjoy strong brand recognition and access to discounts on wholesale fuel. However, unbranded independent stations have more control over fuel prices and operations.

Assessment of Environmental Factors

Look for any evidence of leaks, contamination, and storage tank issues. Obtain reports like Phase I Environmental Site Assessments to identify risks. Remediation can be costly.

Steps to Buy a Gas Station in BC

1. Identifying Potentially For-Sale Gas Stations

Collaborate with an experienced broker to navigate platforms like Find Businesses 4 Sale for listings that align with your criteria.

Network with industry professionals and attend local business events to uncover hidden opportunities in the market.

2. Conducting Comprehensive Due Diligence

Evaluate the business's financial health, including revenue streams, expenses, and profit margins.

Inspect physical assets, such as equipment, to ensure they are in good condition and meet industry standards.

Review existing branding agreements and potential for rebranding opportunities.

Investigate environmental status, including an environmental soil assessment to check for any contamination.

Confirm all necessary licenses and permits are in place and transferable.

3. Financing a Gas Station Purchase

Compare financing options from commercial banks, credit unions, and the Business Development Bank of Canada (BDC).

Consider seller financing as an alternative, especially if it offers favorable terms.

Assess the working capital required for post-acquisition activities like renovations, inventory stocking, and operational expenses.

4. Legal and Regulatory Considerations

Engage with legal experts to navigate the complexities of acquiring a business in BC.

Ensure compliance with provincial and federal fuel storage, transportation, and handling laws.

Secure and verify permits related to underground storage tanks and waste management.

5. Environmental Laws and Liability

Adhere to British Columbia's stringent environmental regulations.

Conduct thorough environmental risk assessments, including soil and groundwater testing.

Implement necessary remediation strategies to manage and mitigate any identified environmental risks, ensuring compliance and avoiding future liabilities.

6. Closing the Deal

Finalize negotiations and agree on a fair purchase price.

Prepare and review all legal documents with your legal advisor.

Secure financing and complete the transaction.

7. Transitioning Ownership

Develop a transition plan for a smooth handover of operations.

Engage with existing staff and understand the operational dynamics.

Implement changes gradually to maintain customer loyalty and staff morale.

Economic Aspects

Analyzing the financial workings of a gas station provides key insights into viability and valuation.

Revenue Streams for Gas Stations

The main income sources are fuel sales, convenience store merchandise, and food service. Secondary revenues come from services like car washes, ATMs, and electric vehicle charging.

Costs of Running a Gas Station

Major costs include wholesale fuel, labor, utilities, licensing fees, garbage collection, bank charges, repairs, and maintenance. Convenience store inventory must be right-sized to avoid waste.

Evaluating the Best Gas Stations for Sale

Properly assessing a potential acquisition target is crucial before making an offer.

Valuation Techniques for Gas Stations

Consider metrics like fuel volume, margins, convenience sales, location, land value, and competition. Calculate price based on multiples like EBITDA. Benchmark against recent comparable sales.

Deep dive into financials: Analyze fuel volume margins and trends over multiple years.

Scrutinize convenience store sales: Break down revenue sources, assess product mix effectiveness, and evaluate growth potential.

Location analysis: Study traffic patterns, neighborhood demographics, and future development plans in the area.

Land value assessment: Consider future potential uses and zoning possibilities.

Competitive landscape: Analyze direct and indirect competitors, evaluating their strengths and weaknesses.

Use industry-specific multiples: Calculate valuation using multiples of EBITDA, considering industry benchmarks and regional variations.

Carrying Out a Physical Inspection

Inspect all aspects thoroughly - fuel tanks, pumps, canopy, store, food areas, inventory. Assess staffing needs and operational processes. Identify any upgrades required.

Conduct detailed checks of fuel tanks and pumps for safety and efficiency.

Evaluate the condition of the store, food areas, and canopy, considering customer appeal and regulatory compliance.

Inventory management assessment: Review turnover rates and stock variety.

Staffing and operations: Analyze current staff skills, staffing needs, and operational processes for potential improvements.

Assess technology use: Evaluate the POS system, back-office software, and other technology for modernization opportunities.

Potential Challenges and Risks of Buying a Gas Station

Being aware of the common difficulties can help create effective mitigation strategies.

- Dealing with Dropping Sales

Implement dynamic pricing strategies for fuel, enhance in-store offerings, and explore loyalty programs.

- Handling Environmental Issues

Conduct thorough environmental audits and assessments, including soil and groundwater testing. Develop a robust environmental management plan.

- Adapting to Market Changes

Stay informed about industry trends like alternative fuels, EV charging demand, and changing consumer habits. Innovate with new services like parcel pickup/drop-off points.

- Legal and Regulatory Compliance

Ensure all licenses and permits for the gas station are current and understand local, state, and federal regulations. Compliance with laws, especially environmental and safety standards, is crucial to prevent future legal issues.

- Marketing and Growth Potential

Evaluate the effectiveness of current marketing strategies and explore growth opportunities. Assess the potential for community engagement and local partnerships to increase brand visibility and customer base expansion.

- Financial Health Check

Review the financial obligations of the gas station, including debts and liens. Analyze cash flow and working capital needs to understand the business's financial viability and immediate investment requirements.

Concluding Thoughts on Buying a Gas Station in BC

Preparation is Essential

Buying a gas station in BC requires thorough operational, financial, and regulatory diligence. Working with specialized advisors like legal experts, environmental consultants, and brokers is crucial for a successful acquisition.

Future Trends and Opportunities

The BC gas station industry is evolving with market consolidation and a shift towards sustainability. Adapting to trends like electric vehicle charging and eco-friendly practices is key. Despite challenges, gas stations offer a solid investment opportunity due to steady demand.

Finding the Right Gas Station Opportunity in BC

With hundreds of gas stations across British Columbia, finding the right opportunity requires a targeted approach.

Defining Your Criteria

Determine the key factors for your ideal acquisition, including location, size, expected profitability, branded vs. independent, and growth potential. Rank your must-haves vs. nice-to-haves.

Researching the Local Market Dynamics

Analyze area demographics, traffic patterns, competitor density, community infrastructure, and zoning. Drive around potential sites at different times to assess customer flow.

Working with a Specialized Broker

Experienced brokers have exclusive access to listings before they hit the open market. They can also provide off-market opportunities that align with your goals. Lean on their expertise.

Evaluating Listings Thoroughly

Assess all listing details critically, including financials, equipment, branding contracts, environmental status, and licensing. Validate every claim to uncover red flags.

Structuring Your Offer Strategy

Determine price thresholds based on property valuations and profitability benchmarks. Prepare your most substantial offer package with optimal terms to secure the deal.

Financing Your Gas Station Acquisition

Securing funding is a key step to complete the purchase process.

Types of Financing Options

Explore bank loans, credit union lending, BDC loans, private financing, seller financing based on asset collateral, and government small business loans or grants.

Managing the Down Payment

A 20-30% down payment is typical for gas station purchases. Seller financing can ease down payment burdens. Have equity lined up before making offers.

Understanding the Approval Criteria

Lenders assess your creditworthiness, business plan, financial projections, equity contribution, and collateral value. Be ready to demonstrate the ability to repay.

Allowing Time for Approval

Leave ample time for financing, especially if seeking SBA guarantees or government loans. The process can take 4-12 weeks, depending on lender requirements.

Setting Yourself Up for Success Post-Acquisition

Once you finalize the purchase, proper planning ensures a smooth transition and continued profitability.

Having a Detailed Business Plan

Map out your brand positioning, target customer base, marketing strategy, capital investments, merchandise mix, fuel supplier terms, and 3-5-year financial projections.

Investing in Facility Upgrades

Upgrade aging equipment, storage tanks, signage, lighting, landscaping, EV chargers, etc., in a phased manner. Prioritize fixes with direct ROI.

Hiring and Training Skilled Staff

Recruit experienced managers and attendants. Conduct extensive customer service and safety training. Perform background checks. Pay competitive wages.

With the right homework and professional guidance, purchasing a thriving gas station in British Columbia is an attainable goal. Let the journey begin!

Let Us Help You in Your Gas Station Ownership Journey

We hope this guide provided valuable insights into successfully buying, operating, and selling gas stations in Alberta. The process involves extensive research and planning.

For years, FindBusinesses4Sale has helped entrepreneurs across Canada realize their dreams of gas station ownership. We walk you through every step, from search to closure.

Stop wasting time searching multiple websites. The most comprehensive gas station listings are available through our free membership platform.

Join today to:

Use our custom tools to track and evaluate listings

Receive tailored recommendations from our experts

Obtain free business valuation estimates

Network with specialized lenders and brokers

We've simplified the complex process of buying a gas station business. Ready to find your ideal gas station opportunity in Alberta? Register now to begin your entrepreneurial journey with us.

FAQ

How much does it cost to buy a gas station in Canada?

Initial investment in a gas station in Canada ranges from $1.5 million to $6 million, varying based on land value, lot size, and product service offerings (convenience stores, quick service restaurants, carwash, etc.). More about gas station investments in Canada.

How much do gas station owners make in Canada?

Owners of successful gas stations in Canada can earn between $40,000 and $100,000 annually. The industry continues to grow, with more cars on the road each year. Most gas stations average about 3 cents a litre profit after expenses on fuel sales. Further details on gas station profitability.

Can you invest in gas stations?

Investing in gas stations involves high costs, ranging from a few hundred thousand dollars to over a million. Evaluating the station, land cost, potential for success, and the convenience store's profit potential is crucial before buying. Insights on investing in gas stations.

How many gas stations are there in BC?

British Columbia has 1,368 gas stations, with 279 located in Metro Vancouver, as the Ontario-based Kent Group reported. Statistics on gas stations in BC.

What are some important considerations before purchasing a gas station in BC?

Before buying a gas station in BC, factors include business profitability, location, environmental compliance, necessary licenses and permits, potential for growth or expansion, existing contracts with fuel suppliers or franchises, and local market competition.

How can potential buyers find listings for gas stations for sale in BC?

Listings for gas stations for sale in BC can be found on online property listing sites, through engagement with local real estate agents, and by contacting business brokerage firms specializing in gas station transactions.

Is owning a gas station a profitable endeavor in BC and what factors might influence this?

Owning a gas station in BC can be profitable, especially with consistent fuel demand. However, location, competition, operational costs, and environmental regulations can significantly affect profitability.

What is the approximate cost of buying a gas station in BC?

Buying a gas station in BC varies, depending on location, size, and profitability, and can range from around $1 million to over $5 million.

How to find the best deals on properties for Gas Stations in BC?

Discovering the best deals on Gas Stations in BC requires thorough research. Take into account factors such as location, size, amenities, and future growth potential. Explore the three most popular offers:

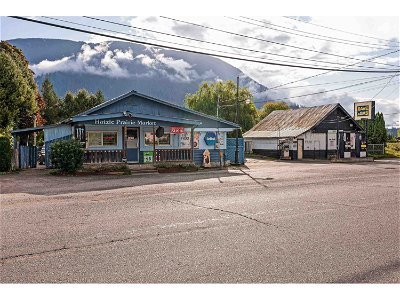

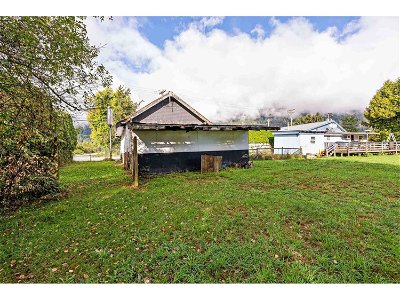

Gas Station at 10806 FARMS ROAD , Gas Station at 106 BRINK STREET and Gas Station at 5228 9th Avenue .

What is the average price of Gas Stations in BC?

The average price of Gas Stations in BC is influenced by various factors. On average, prices range from $1,655,484. However, conducting a comprehensive market analysis is essential to grasp specific pricing trends in your desired area.

Where can you find information about Gas Stations in BC?

Find comprehensive information about Gas Stations in BC on Find Businesses 4 Sale! Explore our catalog of offers, and if you have any questions, feel free to contact us; we're here to help! Meanwhile, consider checking out the three newest listings:

Gas Station at 10806 FARMS ROAD , Gas Station at 106 BRINK STREET and Gas Station at 5228 9th Avenue . .

Save Search

Save Search