Top Hotels for Sale in Canada July 2023

Introduction to Hotels for Sale in Canada

The hospitality industry in Canada offers numerous opportunities for investors. As the world's second-largest country, Canada boasts diverse landscapes and cultural experiences, attracting tourists from around the globe. Several options are available if you are looking for hotels for sale in Canada. The hospitality industry in Canada offers promising investment opportunities, and finding the right hotel property can be a lucrative venture.

Why Invest in Canadian Hotels

Investing in hotels in Canada can yield substantial financial rewards due to the country's robust tourism industry. With a steady stream of international and local tourists, hotel owners can anticipate consistent demand. The favourable exchange rate and political stability further enhance Canada's attractiveness as a hotel investment destination.

Understanding the Canadian Hotel Market

The Canadian hotel market is as diverse as the country itself. There is a hotel property to match any investment strategy with urban luxury hotels, quaint bed-and-breakfasts in small towns, and everything in between.

Types of Hotels for Sale in Canada

There are several types of hotels available for purchase in Canada. Each offers its unique benefits and considerations.

Luxury Hotels and Resorts

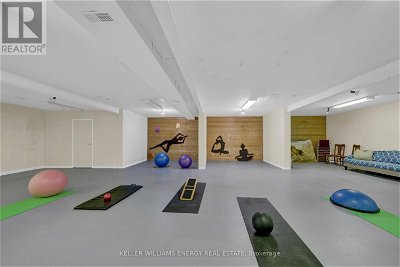

Luxury hotels and resorts often command the highest prices. However, they also offer the most amenities and the highest return on investment. These properties are often located in major cities or popular tourist destinations.

Boutique Hotels

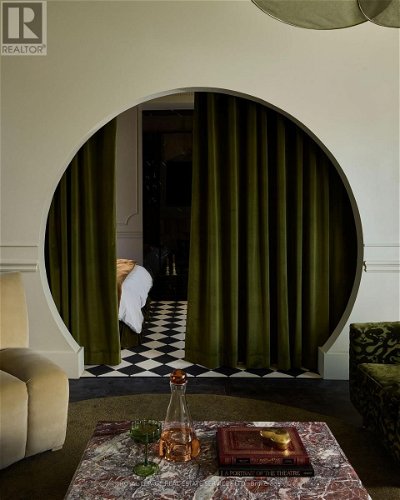

Boutique hotels are smaller, more unique properties. They offer a personalized experience and are often located in fashionable, urban neighbourhoods or charming towns.

Budget-friendly Hotels

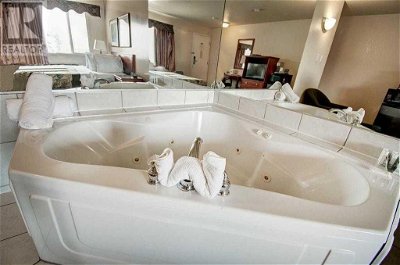

Budget-friendly hotels cater to travelers seeking affordable accommodation. These properties may lack some of the amenities of their more luxurious counterparts, but they offer considerable potential for high occupancy rates.

Bed and Breakfasts

Bed and breakfasts provide an intimate, homely experience. They are often located in scenic or historic areas and can offer a high return on investment due to their lower operating costs.

Motel Chains and Independent Motels

Motels, both chain and independent, provide affordable accommodation for road travelers. They are typically located along highways or in smaller towns.

Top Locations for Hotels for Sale in Canada

Several locations are particularly lucrative for hotel investments.

Toronto

Toronto, serving as Canada's most populous city and a key global hub, presents a bustling market for hotels and a wide array of other businesses for sale, establishing itself as a fertile ground for diverse investment ventures in Canada.

Market Trends and Opportunities

The Toronto hotel market is characterized by steady demand driven by business travelers and tourists. The city's status as a significant economic and cultural center ensures a constant flow of visitors.

According to the City of Toronto, in 2019, the total number of hotel nights sold reached 6.4 million, and there were $6.5 billion dollars in visitor spending. The total economic impact for Toronto was $10.3 billion dollars.

Popular Hotels for Sale in Toronto

There are many attractive hotels for sale in Toronto, from luxury downtown properties to affordable motels in the city's outskirts.

Vancouver

Vancouver is renowned for its stunning natural beauty, drawing tourists worldwide.

Market Trends and Opportunities

Vancouver's hotel market benefits from the city's popularity as a tourist destination. In addition, Vancouver's status as a gateway to the Pacific and its growing tech industry contribute to steady demand for hotel rooms.

Throughout 2022, Vancouver’s hotel market reached a room occupancy rate of 72.9%, which is also the highest amongst major Canadian urban hotel markets. This represents a 50.4% year-over-year growth in the utility of hotel room supply.

Popular Hotels for Sale in Vancouver

Hotels for sale in Vancouver range from luxury waterfront properties to budget-friendly hotels in the city's vibrant neighborhoods.

Montreal

With its rich history and vibrant culture, Montreal is another attractive location for hotel investments.

Market Trends and Opportunities

Montreal's hotel market benefits from the city's strong tourism industry and its status as a hub for events and festivals.

Popular Hotels for Sale in Montreal

Potential investors can find various hotels and businesses for sale in Montreal, from luxury properties in the city's historic center to budget-friendly options in trendy neighborhoods.

Calgary

Calgary, a central hub for Canada's oil and gas industry, offers numerous opportunities for hotel investments.

Market Trends and Opportunities

Calgary's hotel market is driven by business travel related to the energy sector and tourism to nearby natural attractions.

Popular Hotels for Sale in Calgary

Hotels for sale in Calgary range from upscale downtown properties to motels catering to highway travelers.

Other Hotspots

Other promising locations for hotel investments in Canada include rural retreats, lodges, up-and-coming cities, and tourist destinations.

Rural Retreats: Hotels in rural areas offer a tranquil getaway for travelers seeking peace and a connection with nature. Locations near national parks or regions of natural beauty can be particularly profitable.

Lodges: Lodges, especially those in regions popular for outdoor activities like the Rockies, present unique investment opportunities.

Up-and-Coming Cities: Cities like Halifax and Hamilton are developing rapidly and attracting more tourists. These cities provide growth potential for hotel investments.

Well-Known Tourist Destinations: Places such as Niagara Falls, Whistler, and Prince Edward Island consistently draw visitors, making them ideal locations for hotel investments.

Legal and Financial Considerations for Buying Hotels in Canada

Investing in Canadian hotels involves several legal and financial considerations.

Licensing and Regulations

Hotels in Canada must comply with various licensing and regulatory requirements, including health and safety regulations and liquor licensing laws.

Financing Options and Loans

Potential hotel buyers can explore various financing options, including commercial loans, owner financing, and real estate investment trusts (REITs). For a detailed guide on what to consider when exploring these options, check out our Hotel Investment Financial Checklist. This resource provides a comprehensive list of financial factors when investing in a hotel.

Buying a Hotel: A Financial Checklist (verdant.co)

Tax Implications and Benefits

Investing in a hotel in Canada can offer tax benefits, such as the ability to deduct business expenses. However, investors should also be aware of potential tax liabilities.

International Investors and Immigration Programs

Canada welcomes international investors, and several immigration programs are available that could allow foreign hotel owners to move to Canada.

Explore and Asses the Best Hotels for Sale in Canada

There are several resources and strategies to consider when looking for hotels in Canada.

Working with a Commercial Real Estate Agent

A commercial real estate agent with experience in the hotel industry can be invaluable. They can provide access to listings, offer insights into market trends, and assist in negotiations.

Online Listings and Resources

Several online platforms list hotels for sale in Canada like FindBusinesses4Sale. The platform offers an easy-to-use interface where potential buyers can browse through a wide range of hotel listings across Canada. This platform provides a wealth of information for each listing, including location, price, photos, and a detailed property description. This allows investors to gather essential details about potential investments right from the comfort of their homes.

Tips for Evaluating Your Investment

When considering a hotel investment, you should analyze more than just the price tag. The process involves a comprehensive examination of various aspects:

Market and Developmental Prospects Analysis

It's essential to consider not just the present but also the future. Investigate the local municipality's information and future development plans in the area. These factors could significantly impact the hotel business. Be informed about potential changes in the locale that could affect your investment.

Property Condition and Environmental Considerations

The hotel's physical state and environmental compliance are critical. Examine the hotel's infrastructure and equipment, and scrutinize the outcomes of any environmental tests.

The structural condition and any potential environmental issues could considerably affect your investment. Rely on professionals such as licensed soil testers and inspectors for accurate assessments.

Tourism Trends and Local Demand

The success of your hotel investment depends on its attractiveness to tourists and the local demand. Study local tourism trends and demand indicators. The strength of the local tourism industry and the hotel's appeal to tourists are significant factors.

Remember, each step you take in understanding the market and the property gets you closer to a successful investment.

Negotiating and Completing the Sale

Once a suitable property has been identified, the following steps are negotiation and sale completion.

- Making an Offer

The first step in buying a hotel is making an offer. This should be based on a thorough evaluation of the property and its financial performance.

- Due Diligence and Inspections

After an offer is accepted, the buyer should conduct due diligence. This includes a thorough inspection of the property and a detailed review of its financial and legal status.

- Closing the Deal and Transferring Ownership

Once due diligence is completed, the sale can be finalized. This involves signing a purchase agreement, paying the purchase price, and transferring property ownership.

Conclusion: Investing in Canadian Hotels for Sale

Investing in hotels for sale in Canada can be a profitable venture. The country's stable economy, strong tourism industry, and diverse hotel market create numerous investor opportunities. If you are considering investing in this sector, several factors and resources exist to explore.

When considering investing in hotels in Canada, it's essential to weigh the advantages. The hotel industry in Canada offers a high potential for return on investment (ROI) and tax efficiency, making it an attractive option for investors. Additionally, many properties have room for improvement, allowing investors to add value and increase profitability over time.

Overall, Canada's hotel real estate market is a promising sector for investors. With a wide range of Canadian hotels for sale and opportunities for growth, now may be the perfect time to explore the possibilities in this thriving industry.

Future Outlook for the Canadian Hotel Industry

The future outlook for the Canadian hotel industry is promising. With the continued growth of tourism and a robust economy, demand for hotel accommodations is expected to remain strong. Additionally, unique opportunities may arise from shifting travel trends, such as increased interest in rural retreats and eco-tourism.

Despite the potential challenges, including economic fluctuations and changes in travel restrictions, the resilience of the Canadian hotel industry is evident. As long as people continue to travel for business or pleasure, there will always be a demand for accommodations. This makes investing in hotels a potentially profitable endeavour.

Remember, due diligence and a solid market understanding are key to success in hotel investment. Be prepared to take your time, research, and seek professional advice when necessary. The right opportunity is around the corner.

Join FindBusinesses4Sale Membership Base

Join our buyer’s membership base for free with a valid email address and a strong password. You can access all our premium features as a qualified buyer on our website. Those features include saving your search results and accessing the same filters whenever you enter the site.

Plus, we'll send you email updates when we find a hotel for sale in Canada that fits all your needs, so you can be one step ahead of your competitors and the first to access premium listings.

Reasonable Market Prices

Our listings are curated to feature properties with the most competitive prices in Canada, ensuring you find a hotel that fits your budget. Simply set your preferred price range using the filter function, and we'll handle the rest.

We know that buying or selling a business can be overwhelming, but we're here to guide you every step of the way. Contact us today, and let us help you make business sales and connect with the sellers to make a deal. Don't miss out on the perfect opportunity to achieve your business goals in Canada. Thanks to Find Businesses 4 Sale, finding the perfect hotel to start your future business has never been easier!

FAQ

Is it lucrative to own a hotel?

Having a hotel can lead to substantial earnings, especially if you strike the right balance between location, pricing, the condition of the premises, promotional tactics, committed staff, and supportive stakeholders. Nonetheless, profitability is not guaranteed, so dedication and effort are required to see financial success.

Is buying a hotel a good investment?

There's a potential for significant returns due to steady demand. The consistent influx of tourists and travelers can ensure good financial outcomes for hotel investors. Furthermore, given the pivotal role of travel and tourism in the global economic framework, hotels play an essential role, making them a promising sector for investment.

What is the difference between a hotel and a motel in Canada?

While hotels might offer amenities like swimming facilities, spa services, and conference rooms, motels typically provide fewer specialty services, although they might have amenities like an outdoor swimming pool. However, both hotels and motels generally provide internet access to guests.

How are hotels regulated in Canada?

In Canada, the hotel sector is subject to rules and regulations set forth by various tiers of governance – including federal, provincial, and local (municipal or regional) authorities.

Is hospitality in high demand in Canada?

The tourism sector in Canada is flourishing, resulting in a heightened need for hospitality offerings. With its diverse attractions, from stunning nature spots to bustling urban centers, Canada attracts a multitude of visitors annually.

What are the best Hotels for sale in Canada?

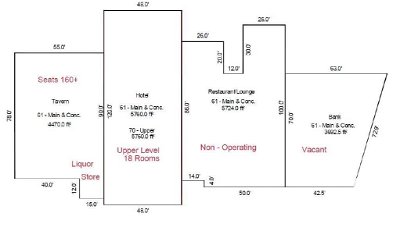

There are many great Hotels for sale in Canada, but some of the top-rated options include Hotel at 109 ST. PAUL CRES , Hotel at 106 CARDEN ST and Hotel at 0 N/A .

Are there any new offers available for Hotels for sale in Canada?

Yes, there are currently some interesting offers available for Hotels for sale in Canada. Check out the following links for more details:

Hotel at 109 ST. PAUL CRES , Hotel at 106 CARDEN ST and Hotel at 0 N/A .

What is the average price of Hotels for sale in Canada?

The average price is around $3,108,800. However, prices can vary depending on factors such as location, size, and amenities.

If you're interested in Hotels for sale in Canada, be sure to click the link above to see all available offers and find your dream. Don't miss out on these amazing deals!

Save Search

Save Search