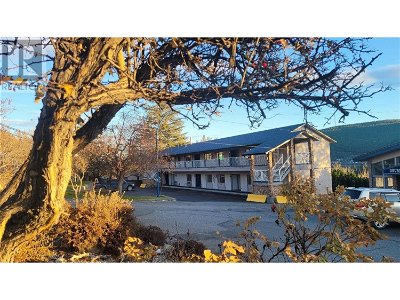

Top Motels for Sale in Canada

Canada's vast geography and abundant natural beauty make it a prime destination for travelers exploring the great outdoors. This creates ample opportunities for entrepreneurs interested in capitalizing on the strong tourism industry by purchasing an existing motel business. When looking for motels for sale in Canada, prospective buyers should focus on key factors like:

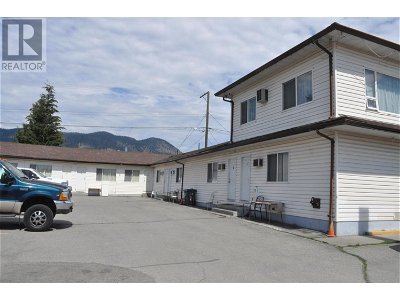

Location - Proximity to major highways, tourist attractions, and amenities

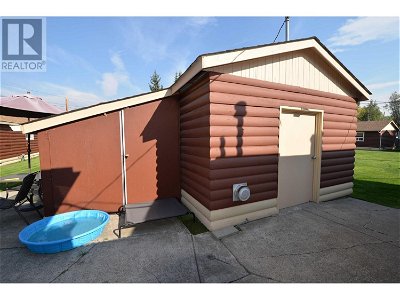

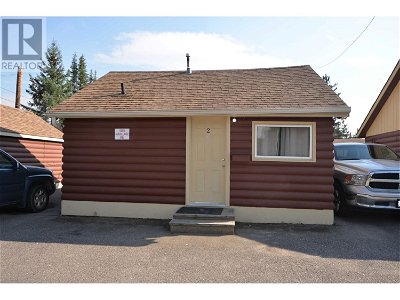

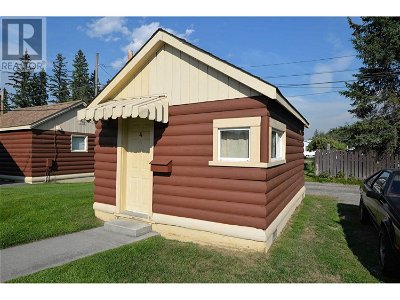

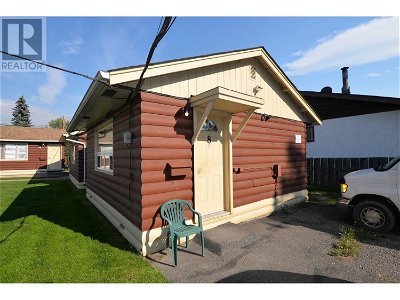

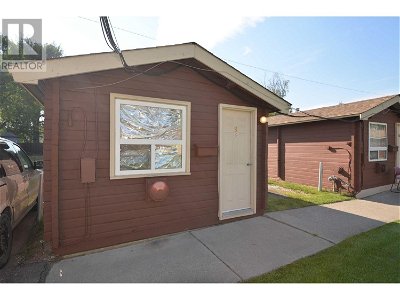

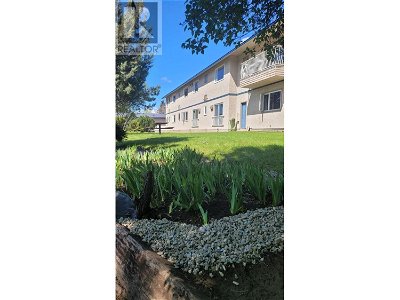

Property condition - Age of buildings, necessary renovations

Local market - Competitiveness, target customer demographics

Financials - Past revenue and operating costs

Thoroughly evaluating these aspects can help determine if a motel will likely provide good value and return on investment.

Prime Locations Across the Provinces

A busy motel is a successful motel. That’s why some of the top-performing motels in Canada are located on Highway 2, Highway 3, Highway 14, Highway 16, and Highway 17. Some other desirable areas to consider include:

British Columbia - Highways 3, 5, and 97 provide access to mountains and beaches

Alberta - Major cities like Calgary and Edmonton and proximity to the Rockies

Ontario - Highways 11, 17, and 69 stretch through lakeside cottages and parks

Quebec - Scenic routes like Highway 20 approaching Quebec City and Charlevoix

Nova Scotia - Coastal highways leading to the Bay of Fundy, Cabot Trail, and more

Pro tip: Check municipal development plans to avoid buying in areas with potential future zoning changes or land restrictions.

Key Factors in Purchasing a Motel

When evaluating potential motel purchases in Canada, prospective buyers should carefully examine the following:

Location - Finding a property near major highways, tourist sights, and amenities can drive higher occupancy and room rates.

Condition - Older properties may require plumbing, electrical or HVAC upgrades—factor in room renovation costs.

Market dynamics - Research current and forecasted demand and average daily rates for the area. Analyze local events, attractions, and transportation access bringing travelers to that market.

Financials - Review historical revenues, operating expenses, profit margins, and seasonality. Scrutinize previous ownership's projections.

Location

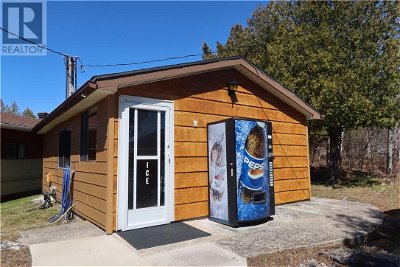

Pinpointing the right location is critical to maximizing occupancy and room rates.Ideal properties have high visibility and easy access to highways and airports is ideal, like the motels for sale in Chetwynd, BC.

British Columbia, Nova Scotia, Alberta, and Ontario traditionally offer strong motel locations near popular tourist regions and have various resorts for sale. Also, research the local amenities, events, and attractions motels can benefit from. Proximity to restaurants, shops, parks, sporting events, and conferences can help fill rooms.

Drive the area during the peak season to see traffic patterns and feel the vibe. Crunching numbers on past performance means little if the fundamentals of the location are not strong.

Assessing the Property's Condition

While cosmetic renovations like new paint or furniture are relatively affordable, major upgrades to plumbing, HVAC, electrical, or roofing can require significant capital.

Inspect the physical premises and equipment thoroughly or hire experienced contractors to identify any issues. Obtain disclosures about known defects.

Consider long-term cap ex needs for regular maintenance. Ensure compliance with safety codes and accessibility regulations. An ounce of prevention is worth a pound of cure when it comes to avoiding big surprise repair bills down the road.

Understanding the Local Market Conditions

In addition to ingress/egress and area attractions, investigate demand generators like local industries, event venues, and transportation options. Look at both current and forecasted conditions.

For example, is a new convention center being built nearby that will draw more corporate travelers? Is an existing manufacturing plant at risk of closing? Tracking occupancy, average daily rates, and RevPAR for comparable area motel businesses can indicate the market's profit potential.

Compiling data on seasonality and midweek vs. weekend patterns is also helpful for revenue projections.

Analyzing Financial Statements

Request at least 3 years of income statements, balance sheets, cash flow statements, and tax returns from the seller.

Dig into details on revenues, expenses, operating margins, profitability trends, and earning potential.

Validate the accuracy of provided figures. Assess the business's assets and liabilities. Develop different models for best and worst-case scenarios.

A motel's past financials always provide key insights into its prospects.

Costs Associated with Buying a Motel in Canada

Purchasing an existing motel business involves more than just the sale price. Be prepared for expenses like inspections, financing, renovations, and operating costs.

Purchase Price

The seller's asking price provides a starting point for negotiation. But take steps to determine fair market value:

Review recent sales of comparable properties based on size, age, location, and amenities.

Calculate the price per room and compare it against market norms. For example, a considerable variance could indicate issues if the average price/room is $200k.

Factor in any significant repairs or renovations above and beyond typical maintenance. This should reduce fair value.

Scrutinize historical revenues and operating expenses. If profitability is below average, negotiate a lower price.

Consider intangibles like existing brand name, loyal customer base, and potential expansion opportunities that could command a premium valuation.

Assess current economic conditions influencing valuations like rising interest rates or recession risks.

Hiring a commercial real estate appraiser can provide an independent, expert valuation opinion to support negotiations. This upfront cost is minor compared to overpaying.

Leave yourself bargaining room to walk away rather than overstretching on price.

Building Inspections

Thorough property inspections by qualified professionals help identify defects and necessary repairs. Budget $5,000-$10,000 for assessments like:

Structural and roof - Look for cracked foundations, deteriorated load-bearing elements, and leaky roofs. These can require significant repairs.

Electrical, plumbing, HVAC - Faulty wiring, corroded pipes, and outdated HVAC systems can create fire risks and comfort issues.

Environmental - Test for mold, asbestos, and radon, which may require remediation.

ADA compliance - Ensure sufficient handicap-accessible rooms, entry ramps, and door clearances.

Fire safety - Confirm functioning alarms, sprinklers, and emergency exits to meet codes.

Septic tank - Inspect capacity and condition for remote locations.

Parking lot - Evaluate pavement condition, drainage, and striping.

Crime prevention - Assess exterior lighting, keycard door locks, and security cameras.

Prioritize any deficiencies threatening safety, followed by those impacting operations. Negotiate repair credits from the seller where possible.

Financing Options

Typical financing sources include:

It pays to shop for the best loan rates and terms tailored to your business plan. Consider factors like:

Interest rates - Compare rates from banks, credit unions, and private lenders. Weigh fixed vs. variable rates and implications for cash flow.

Down payment - Lenders may require 10-25% down. Weigh tradeoffs of higher down payments to secure better rates.

Amortization - Longer terms like 20-25 years reduce monthly payments but increase interest costs.

Pre-payment terms - Assess penalties for accelerated repayment in case you sell.

Collateral - Some lenders may require cross-collateralization across multiple property assets.

The ideal financing mix aligns with your growth strategy and cash flow capabilities. Consult commercial lending experts to map out optimal structures. Once you run the numbers, the lowest rate financing may not always fit.

Renovations and Improvements

Upgrade costs will depend on the property's condition. Budget for:

Cosmetic - paint, furniture

Electrical, plumbing, appliances

Lobby, pool, common areas

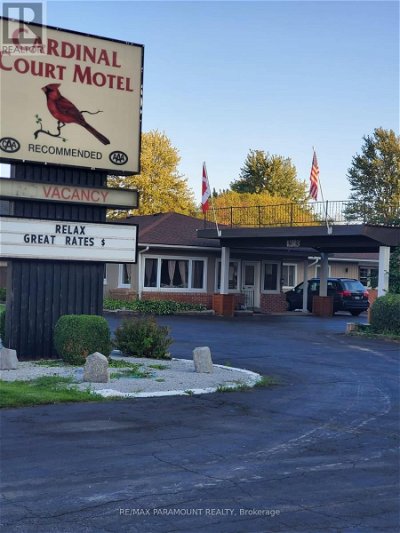

Signage, parking, landscaping

Not all upgrades are equal regarding return on investment (ROI). Prioritize enhancements that increase revenue or occupancy more than the capital outlay.

For example, refreshing dated room decor and furniture for $2,000 per room can often boost rates by $10-20. A new lobby facade and entrance sign visible from the highway may increase walk-ins and awareness.

But a luxury swimming pool costing $50,000 may do little to attract target customers or justify the expense. Focus first on fixes delivering the biggest bang for the buck.

Conducting ROI analysis on potential renovations can inform intelligent investment decisions. Move forward only on enhancements demonstrating a sound business case rather than chasing trends.

Operating Expenses

Recurring costs include:

Staff wages and benefits

Property maintenance and repairs

Utility bills - electric, water, heating

Insurance, licensing, taxes

Franchise or marketing fees

Reservations system, supplies

When reviewing historical financials, scrutinize both fixed and variable operating expense information. Drill into details on wage rates, maintenance and utility costs per room, franchise fees, and top expense categories. Compare against industry benchmarks.

Evaluate operating margins over the past 5 years - are profitability trends positive or negative? Verify significant capital investments like renovations that could alter expense patterns.

Also, scrutinize the seller's forward-looking projections. Do their forecasts for revenue growth and new construction seem realistic? Is inflation appropriately factored into future staffing and supplies budgets? Obtain documentation supporting their assumptions.

Operating expenses can make or break profitability. So rigorously vet both history and projections to avoid any unpleasant surprises.

Preparing to Buy a Motel in Canada

Properly preparing to purchase an existing motel or construct a new one can make the venture successful.

Assembling Your Professional Team

Surround yourself with specialists who can provide expert guidance, data and information like:

Real estate agent - Local market knowledge, valuation, sales process.

Lawyer - Review contracts and licenses, and identify risks.

Accountant - Analyze financials, structuring, and taxes.

Consultants - Feasibility, valuations, marketing plan.

Contractors - Renovation estimates, project management.

Having aligned, experienced professionals ensure you consider all angles—discussing the need for staffing exploration and hospitality experience.

Developing a Business Plan

A detailed business plan is critical for buying or building a motel. Key elements to address include:

- Target customers - Define your target guest segments based on the purpose of travel, demographics, geography, etc. This drives decisions on amenities, pricing, and marketing.

Positioning - Determine your desired competitive positioning for budget, mid-scale, and luxury. Align amenities, service levels, and branding accordingly.

Location analysis - Thoroughly assess traffic patterns, area demand generators, and competitors' positioning/occupancy in selected locations.

Competitive assessment - Research strengths and weaknesses of competitive properties based on guest reviews, amenities, pricing, and experiences staying onsite.

Facilities plan - Outline required renovations, planned amenities and offerings, room types, and F&B facilities to support positioning.

Management & staffing - Define organizational structure, key roles, and salary benchmarks. Hospitality experience is a must.

Marketing & partnerships - Describe target outreach channels like OTA listings, social media, and sales partnerships with complementary businesses.

Financials - Provide 5-year proforma P&L, balance sheet, and cash flow projections based on reasonable assumptions for the target market.

A well-developed plan allows you to spot any holes in strategy and creates an operating playbook. It also demonstrates business viability when seeking financing.

Obtaining Necessary Licenses and Permits

Purchasing an existing motel requires some licensing, but constructing a new build or extensively renovating will likely require:

Municipal business operating license - standard application and fee process

Fire and building permits - inspections to approve electrical, structural, HVAC

Health inspections - for any onsite food service facilities

Local hospitality tax registration - for collecting required occupancy taxes

Liquor license - if offering a bar/lounge area

Signage permits - for new exterior signage visibility

Factor 6-12 months to complete the paperwork maze, especially if new construction. Having consultants who understand local permit processes can accelerate approvals.

Legal Considerations when Buying a Motel in Canada

In addition to permits and licenses, it's essential to understand the web of laws and regulations impacting motel businesses in Canada. Failure to comply can result in fines or even force closure. Key areas to research include:

Zoning bylaws and land use restrictions - Ensure the property is properly zoned for commercial motel/hotel use. Redevelopment plans may impact future operations.

Employment laws - There are many requirements around minimum compensation, worker safety, benefits contributions, and taxes for staff.

Hospitality regulations - Provinces regulate the lodging sector through certification programs, inspections, and inventory reporting rules.

Tax obligations - At the federal, provincial, and municipal levels, motels must comply with income, sales, property, and tourism taxes.

Accessibility standards - Accommodation must be made for mobility, hearing, and visually impaired guests.

Food safety - Onsite restaurants require approvals and adherence to strict food handling procedures.

Building codes - Renovations and new construction must meet electrical, plumbing, and structural safety standards.

Environmental laws - Motels produce large volumes of laundry waste, pool chemicals, and other effluents requiring proper disposal.

Navigating the regulatory environment poses a hurdle for motel owners. Seeking guidance from specialized legal and accounting professionals is highly recommended.

Employment Laws and Staffing Regulations

Employing staff brings legal obligations like:

Minimum wage, overtime, and leave pay requirements

Anti-discrimination and human rights legislation

Workplace safety standards

Mandatory benefit contributions like employment insurance (EI), workers' compensation, Canada/Quebec pension plan

Income tax withholding and T4 reporting

Taxes and Regulations

Factor relevant taxes into planning like:

Business income taxes - federal and provincial corporate tax rates

Property taxes - the municipal tax on land and buildings

Commodity taxes - GST/HST on taxable goods and services

Excise taxes - on liquor sales, for example

Also, address industry-specific regulations like motel licensing requirements. Understanding Entrepreneurship Risks and Challenges

The path to entrepreneurship, though fulfilling, comes with its own set of hurdles. Acquiring and managing a motel for sale in Canada means dealing with various risks, including market fluctuations, financial uncertainties, regulatory adherence, and operational complexities.

Treading this path with a clear understanding and readiness for possible challenges is vital. This awareness boosts your credibility and arms you with the resilience needed to guide your business toward success.

Understanding Entrepreneurship Risks and Challenges

The path to entrepreneurship, though fulfilling, comes with its own set of hurdles. Acquiring and managing a motel for sale in Canada means dealing with various risks, including market fluctuations, financial uncertainties, regulatory adherence, and operational complexities.

Treading this path with a clear understanding and readiness for possible challenges is vital. This awareness boosts your credibility and arms you with the resilience needed to guide your business toward success.

Conclusion

It’s the perfect moment to find a motel or hotel for sale and get into the hospitality business with excellent income. Current owners will sell more cheaply now than after the market has healed. The important thing is to find an excellent location and do your homework. Our business listing site FindBusinesses4Sale, gives you a perfect opportunity to help you quickly choose some of the top motels for sale in Canada.

FindBusinesses4Sale Offers Reasonable Market Prices

Why Buyers Choose FindBusinesses4Sale When making a significant investment, such as purchasing a business, industrial property, or land, having the right resources and platform at your disposal is crucial. Find Businesses4Sale offers a plethora of advantages for potential buyers:

Comprehensive Listings: With FindBusinesses4Sale, you no longer need to juggle between multiple websites. The platform boasts of having the most extensive collection of businesses and commercial properties for sale, ensuring you find the perfect match for your investment needs.

Free Registration: One of the platform's standout features is its free buyer registration service. Not only does this save you money, but it also provides you unrestricted access to many listings.

Instant Alerts: Stay ahead of the competition with real-time alerts. Once a match for your criteria is listed or a message is logged in the system, you'll receive a text message alert, ensuring you never miss out on a golden opportunity.

Confidentiality Assurance: The platform highly emphasizes seller confidentiality. This ensures that key staff and vendors remain unaware of the sale, preventing potential disruptions or unintended consequences. As a buyer, you can trust the platform's process and listings.

FAQ

How profitable is a motel?

The profitability of a motel in Canada depends on various factors, such as the location, occupancy rate, average daily rate, revenue per available room, operating costs, and market size of the hotel and motel sector.

What are the most popular areas in Canada to buy a motel?

Top regions include British Columbia, Alberta, Ontario tourism hotspots, and Nova Scotia. Seek locations along highways and near key attractions and demand drivers. Perform in-depth market research before buying.

Are there specific regulations or requirements for buying and operating a motel in Canada?

Buyers must apply for municipal business licenses, province-level permits, insurance coverage, and tax registration. Zoning laws may also apply. Involve lawyers and accountants to ensure full compliance.

How can I ensure the value and future potential of the motel I'm interested in purchasing in Canada?

Carefully analyze past financial statements, location, competition, market conditions, property assessments, and potential risks. Hire inspectors to assess the physical condition as well. Seek fair valuations aligned with projected performance.

What is obtaining the necessary permits and licenses for operating a motel in Canada?

The application process varies by location. Research requirements upfront and apply early, allowing at least 2-3 months for approvals. Hire experienced local advisors to guide you through the licensing process.

What are the best Motels for sale in Canada?

There are many great Motels for sale in Canada, but some of the top-rated options include Motel at 160 Highway 4 , Motel at 21 Old Victoria Road and Motel at 1850 Yellowhead TR NE .

Are there any new offers available for Motels for sale in Canada?

Yes, there are currently some interesting offers available for Motels for sale in Canada. Check out the following links for more details:

Motel at 160 Highway 4 , Motel at 21 Old Victoria Road and Motel at 1850 Yellowhead TR NE .

What is the average price of Motels for sale in Canada?

The average price is around $1,937,677. However, prices can vary depending on factors such as location, size, and amenities.

If you're interested in Motels for sale in Canada, be sure to click the link above to see all available offers and find your dream. Don't miss out on these amazing deals!

Save Search

Save Search