How to Finance an Apartment Building in Toronto

Whether you’re a seasoned business owner or a wealthy buyer with your sights set on Canada’s commercial real estate, specifically the apartment building sector, the potential for a lucrative investment awaits.

However, capitalizing on this potential requires more than just financial backing – it calls for meticulous planning and specialized insights.

I’m Todd Rammler, founder of Michigan’s Virtual CFO, and here is some critical information about buying and financing an apartment building from years of experience in helping businesses manage their financial planning while acquiring permanent financing or renting buildings.

Why Invest in Toronto

According to Canadian Real Estate Magazine, “The City of Toronto is also a great location for business and commercial properties. For shops, there are many areas with high foot traffic that will get a lot of attention. For offices, you will be in one of Canada’s business hubs which can draw a lot of tenants

Renowned as a dynamic urban hub with robust real estate options, Toronto offers an ideal landscape for property investors and owners seeking to capitalize on the potential of apartment buildings.

Toronto will always give you a return on your investments. The average sq ft in the Toronto Area was around $377.89 for commercial and $398.23 per square foot for offices. This is up significantly from previous years.

What is a Commercial Mortgage

A commercial mortgage is a loan secured by commercial property, an asset such as an office building, shopping center, industrial warehouse, apartment complex, or other types of commercial real estate, rather than residential property. It’s a loan used to purchase, refinance, or develop commercial properties.

How to Get Financing with a loan (even with lower interest rates)

Securing financing for a commercial apartment building in Toronto, Canada, involves a series of steps. Here’s a quick guide to help you navigate the process:

- Determine Your Budget:

- Understand how much you can afford and what size of loan you’ll need.

- Consider all costs, including down payment, closing costs, potential renovation expenses, and other associated fees.

- Prepare Necessary Documentation:

- Personal and business financial statements.

- Income tax returns (usually the last 2-3 years).

- Property details: location, size, condition, occupancy rates, rental income, etc.

- Business plan or proposal, especially if it’s a new venture or significant renovation.

- Research Lenders:

- Traditional banks: Major Canadian banks like RBC, TD, Scotiabank, BMO, and CIBC.

- Credit unions: Local institutions might offer competitive rates.

- Mortgage brokers: They can help you find lenders and negotiate terms.

- Private lenders: Typically more expensive, but they might be more flexible.

- Pre-Approval:

- Before property hunting, get pre-approved for a loan. This will give you an idea of what you can afford and show sellers you’re serious.

- Choose the Right Loan:

- Commercial mortgages can vary in terms, interest rates, and amortization periods. Understand the differences and choose what’s best for your situation.

- Property Appraisal:

- Lenders will require an appraisal to determine the value of the property. This helps them decide how much they’re willing to lend.

- Environmental Assessment:

- Especially important for older buildings, lenders might require an environmental assessment to ensure there are no environmental liabilities associated with the property.

- Negotiate Terms:

- Once you’ve chosen a lender, negotiate the terms of the loan, including interest rates, payment schedules, and any other conditions.

- Finalize the Loan:

- Once everything is agreed upon, you’ll go through the closing process, which includes signing documents and paying any associated fees.

- Stay Compliant

- After securing financing, ensure you meet all the terms and conditions of your loan to avoid penalties or potential foreclosure.

Remember, while these steps provide a general overview, commercial financing can be complex. It’s advisable to work with professionals, such as commercial real estate agents, lawyers, and accountants, who can guide you through the intricacies of the process.

What are Key Financial Planning Documents

Managing the cash flow of a business is crucial for its survival and growth. Proper documentation is essential to ensure that cash inflows and outflows are tracked, analyzed, and optimized. Here are some important documents for planning the financing of the business:

-

- Cash Flow Statement:

- This is a primary financial statement that shows the inflow and outflow of cash in a business over a specific period. It typically covers operating, investing, and financing activities.

- Income Statement (Profit and Loss Statement):

- While not exclusively about cash flow, it provides details on revenues, expenses, and profits, which can be used in conjunction with other documents to assess cash flow.

- Balance Sheet:

- This provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It can give insights into potential cash flow issues, such as rising short-term debts or dwindling assets.

- Accounts Receivable Aging Report:

- This report breaks down the amounts owed to the business by customers. It categorizes outstanding invoices by the length of time they’ve been unpaid, helping businesses identify potential collection issues.

- Accounts Payable Aging Report:

- Similar to the receivables report, this document categorizes the amounts the business owes to its suppliers or vendors based on the length of time they’ve been outstanding.

- Budgets and Financial Projections:

- These documents forecast future revenues and expenses, helping businesses anticipate future cash flow conditions and make informed decisions.

- Cash Flow Statement:

Choosing the Right Property Investment Marketplace

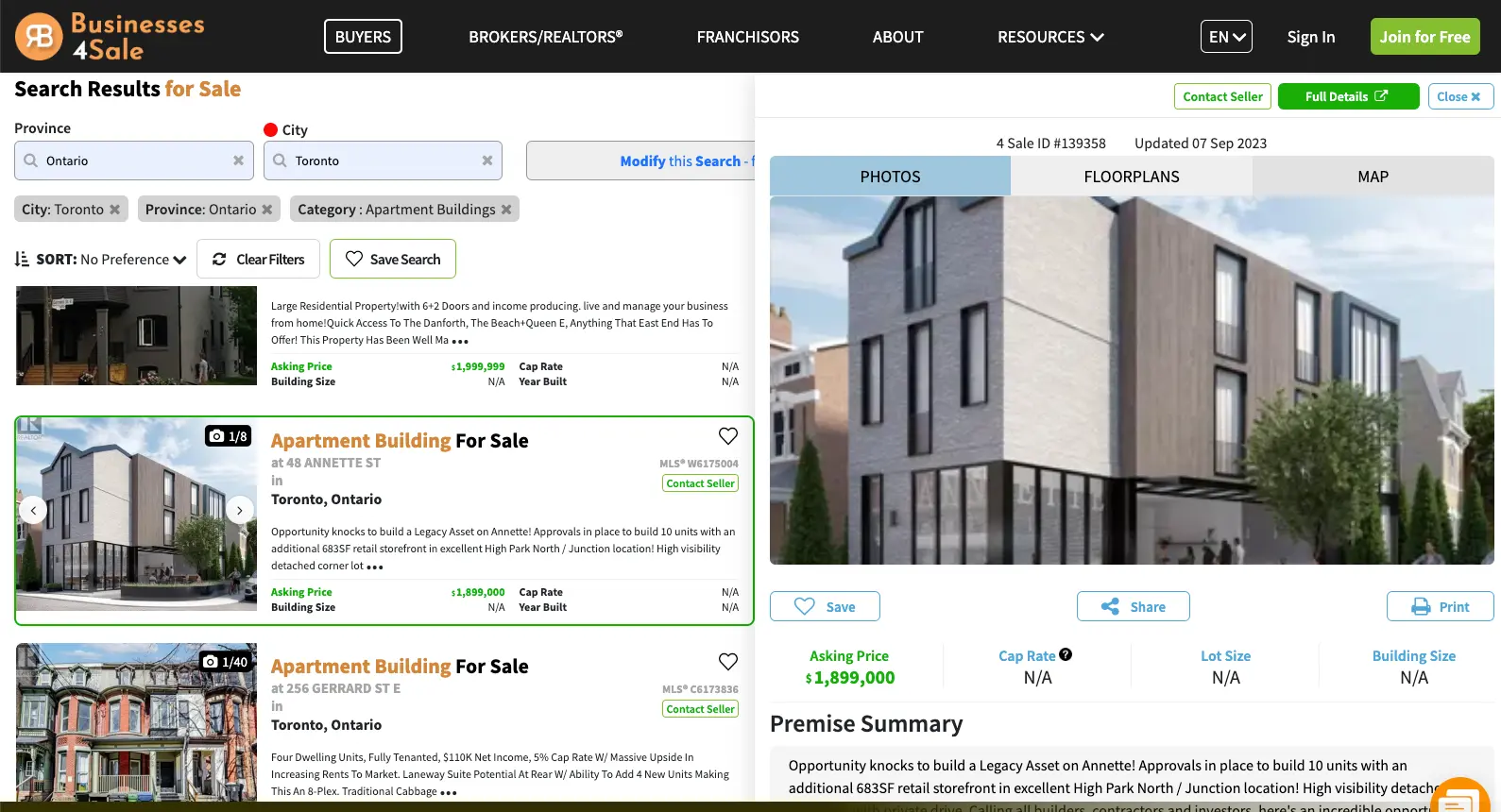

Find Businesses 4 Sale has a great selection of apartment buildings and other rental properties in Toronto. Here’s how to find a rental property here:

1) Go to the commercial search page

Open your preferred web browser.

Enter the URL: https://www.findbusinesses4sale.com/commercial-properties-for-sale/ or click on the provided link.

2) Browse Listings

Once on the site, you’ll likely see a list of commercial properties for sale. Browse through these listings to get an overview.

You can find a lot of properties with five units or more units of apartments.

3) Filter Your Search

Look for search filters or criteria settings. This might include location, property type, price range, etc.

Select “Apartment Buildings” or a similar category if available under property type or category filters.

4) Enter Location Preferences:

If you have a specific location in mind (e.g., Toronto), enter it into the location or city search bar.

5) Click the building

Click the building on the map and then review the listing details.

Find Businesses 4 Sale redefines how investors uncover high-potential properties. Whether you’re exploring opportunities in Toronto’s dynamic real estate markets or considering other prime locations, this platform equips you with the tools and insights needed to thrive.

Alternatives to Financing to a Loan

Although you will likely take a loan due to tax incentives, here are a few alternatives:

-

-

- Venture Capital Investment: Can you and should you use your venture round? Probably not, but it’s an option.

-

-

-

- Crowdfunding Platforms: Leverage the power of a crowd by exploring crowdfunding platforms tailored to real estate investments. If you have a really creative idea for a building or a coworking space, this could be a real option.

-

-

-

- No Money Down or Leveraged Buyouts: Explore the possibility of no-money-down arrangements or leveraged buyouts, where you use the property’s existing equity or value to secure financing without a substantial upfront payment.

-

By incorporating alternative funding methods into your strategy, you’ll gain a competitive edge and increase your capacity to navigate the intricacies of financing an apartment building acquisition.

Elevating Your Property Portfolio

Property ownership offers immense potential for building wealth, but the journey demands thorough understanding, careful planning, and strategic decision-making.

By following these expert tips and steps you’ll be better equipped to navigate the complexities of financing an apartment building, setting yourself up for success in the competitive real estate market. Remember, enlisting the guidance of experienced professionals can significantly enhance your chances of a lucrative investment.

Resources

Canada Mortgage and Housing Corporation

Canadian Real Estate Association

Diversification: The Proven Strategy VCs Use to Win

Investment Crowdfunding: What it Means, How it Works, Benefits

FAQs

How to put less than 20% down on a property?

Putting less than 20% down on a commercial real estate property in Canada (or anywhere else) can be a bit more challenging than with residential real estate due to the perceived higher risks associated with commercial properties. However, it’s not impossible. You can consider Vendor Take-Back Mortgage (VTB), Private Lenders, Partnerships, or Mezzanine Financing.

When can I see an ROI on my rental property?

The return on investment (ROI) for a rental property can vary widely based on numerous factors, including the property’s purchase price, the amount of renovation or improvement costs, the rental income it generates, ongoing expenses, and the property’s appreciation over time.